Table of Contents

Toggle In the fast-paced world of digital banking, finding a platform that simplifies financial transactions while offering robust security features is paramount. This is where digimais fácil.bancodigimais.com.br steps in, a beacon for those seeking a seamless online banking experience. With an intuitive interface and a suite of financial tools at users’ fingertips, it’s quickly becoming a go-to destination for savvy online bankers.

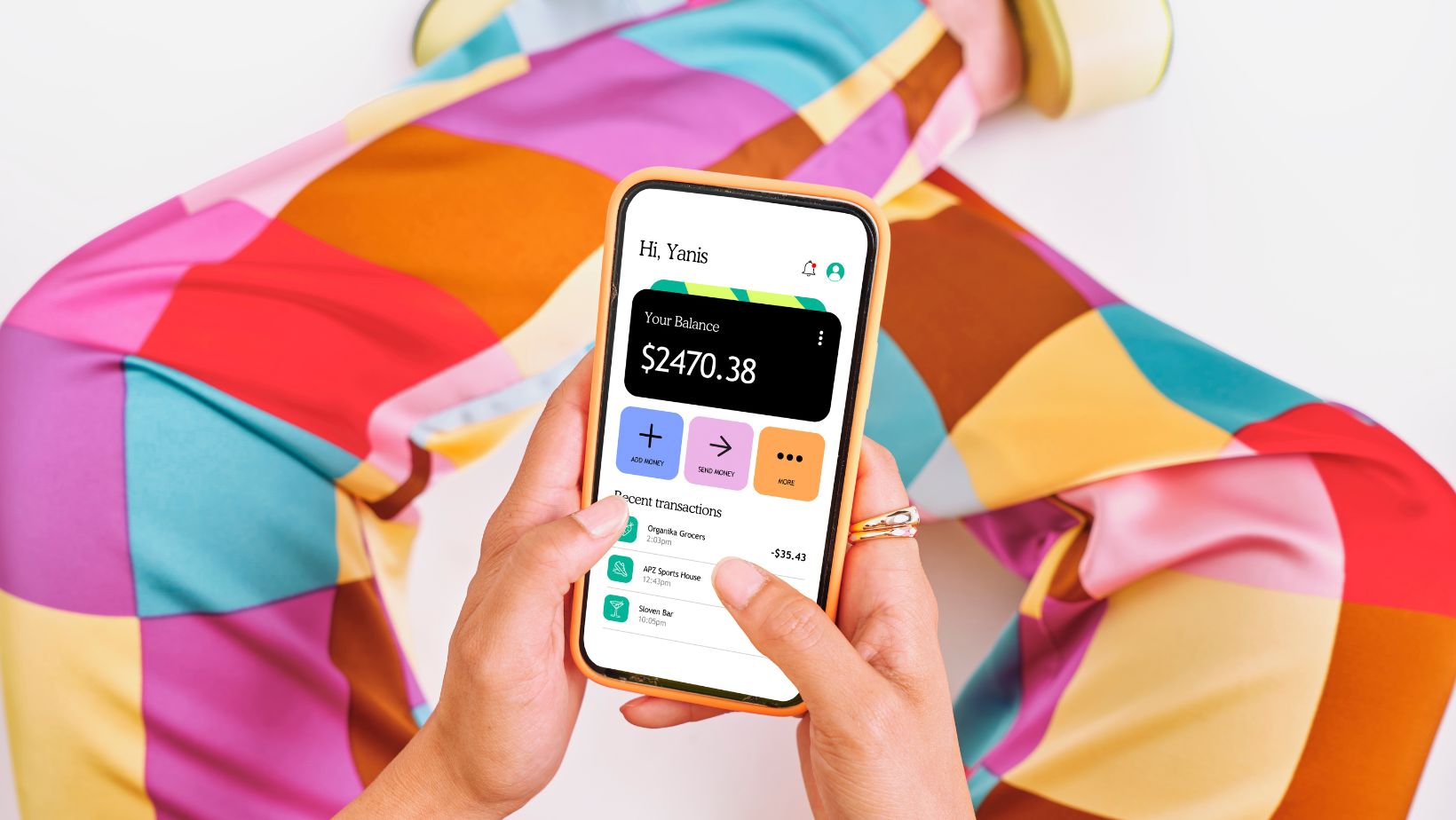

In the fast-paced world of digital banking, finding a platform that simplifies financial transactions while offering robust security features is paramount. This is where digimais fácil.bancodigimais.com.br steps in, a beacon for those seeking a seamless online banking experience. With an intuitive interface and a suite of financial tools at users’ fingertips, it’s quickly becoming a go-to destination for savvy online bankers.

Digimais fácil.bancodigimais.com.br is not just another online banking website; it’s a comprehensive solution designed to cater to the evolving needs of modern consumers. Whether it’s managing accounts, transferring funds, or investing in the future, this platform makes every action smoother and more accessible. As more people look for reliable and efficient ways to handle their finances, digimais fácil.bancodigimais.com.br stands out as a prime example of how digital banking should be.

Digimais Fácil.bancodigimais.com.br

What Is Digimais Fácil?

Digimais Fácil, accessible via fácil.bancodigimais.com.br, defines itself as a dynamic digital banking platform committed to simplifying the financial lives of its users. This platform emerges as a direct counter to traditional banking hassles by offering an online-first approach, allowing individuals to manage their finances anytime and anywhere. Digimais Fácil provides a seamless connection between everyday financial needs and digital solutions, catering to a broad audience looking for efficient, secure, and comprehensive banking experiences without leaving the comfort of their homes.

Digimais Fácil, accessible via fácil.bancodigimais.com.br, defines itself as a dynamic digital banking platform committed to simplifying the financial lives of its users. This platform emerges as a direct counter to traditional banking hassles by offering an online-first approach, allowing individuals to manage their finances anytime and anywhere. Digimais Fácil provides a seamless connection between everyday financial needs and digital solutions, catering to a broad audience looking for efficient, secure, and comprehensive banking experiences without leaving the comfort of their homes.

Financial Products and Services

Following the account opening process at digimais fácil.bancodigimais.com.br, customers gain access to a variety of financial products and services tailored to meet their individual needs. These offerings include a comprehensive range of savings and checking accounts, competitive loans and credit options, and diverse investment opportunities. Each product is designed to enhance the financial well-being of its users, ensuring a seamless and efficient banking experience.

Following the account opening process at digimais fácil.bancodigimais.com.br, customers gain access to a variety of financial products and services tailored to meet their individual needs. These offerings include a comprehensive range of savings and checking accounts, competitive loans and credit options, and diverse investment opportunities. Each product is designed to enhance the financial well-being of its users, ensuring a seamless and efficient banking experience.

Savings and Checking Accounts

digimais fácil.bancodigimais.com.br offers a selection of savings and checking accounts, catering to different financial goals and requirements. The savings accounts come with attractive interest rates, helping customers grow their funds over time. In contrast, the checking accounts provide easy access to funds, with features such as debit cards, online bill payments, and mobile check deposits. Both account types are integrated into the digital platform, enabling users to monitor their balances, view transaction history, and transfer funds with ease.

digimais fácil.bancodigimais.com.br offers a selection of savings and checking accounts, catering to different financial goals and requirements. The savings accounts come with attractive interest rates, helping customers grow their funds over time. In contrast, the checking accounts provide easy access to funds, with features such as debit cards, online bill payments, and mobile check deposits. Both account types are integrated into the digital platform, enabling users to monitor their balances, view transaction history, and transfer funds with ease.

Loans and Credit Options

For those looking to finance personal or business goals, digimais fácil.bancodigimais.com.br presents a range of loans and credit options. Customers can apply for personal loans, auto loans, and home mortgages with competitive interest rates and flexible repayment terms. The digital banking platform simplifies the application process, allowing users to submit their applications online and receive prompt feedback. Additionally, credit card offerings come with various benefits, including reward programs, low annual fees, and extensive merchant acceptance.

For those looking to finance personal or business goals, digimais fácil.bancodigimais.com.br presents a range of loans and credit options. Customers can apply for personal loans, auto loans, and home mortgages with competitive interest rates and flexible repayment terms. The digital banking platform simplifies the application process, allowing users to submit their applications online and receive prompt feedback. Additionally, credit card offerings come with various benefits, including reward programs, low annual fees, and extensive merchant acceptance.

Investment Opportunities

Beyond traditional banking products, digimais fácil.bancodigimais.com.br offers its customers access to a variety of investment opportunities. These include mutual funds, stocks, bonds, and other securities, catering to both novice and experienced investors. The platform provides comprehensive tools and resources to assist users in making informed investment decisions, including market analysis, investment calculators, and personalized financial advice. With a focus on diversification and risk management, customers can build and manage their investment portfolio directly from the digital banking platform.

Beyond traditional banking products, digimais fácil.bancodigimais.com.br offers its customers access to a variety of investment opportunities. These include mutual funds, stocks, bonds, and other securities, catering to both novice and experienced investors. The platform provides comprehensive tools and resources to assist users in making informed investment decisions, including market analysis, investment calculators, and personalized financial advice. With a focus on diversification and risk management, customers can build and manage their investment portfolio directly from the digital banking platform.